A comprehensive high-tech solution for Swedbank’s loyalty program

About the client

Swedbank was founded in 1820 in Sweden. The largest bank in the Baltics – numbers about 206 branches in Estonia, Latvia and Lithuania. It provides services to 9.5 mln. physical persons and 622 thous. corporate clients in four countries.

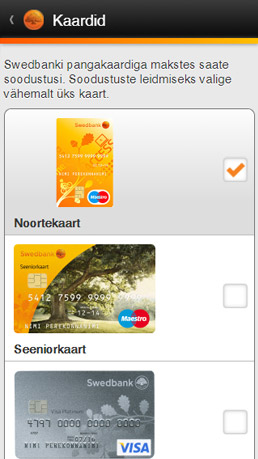

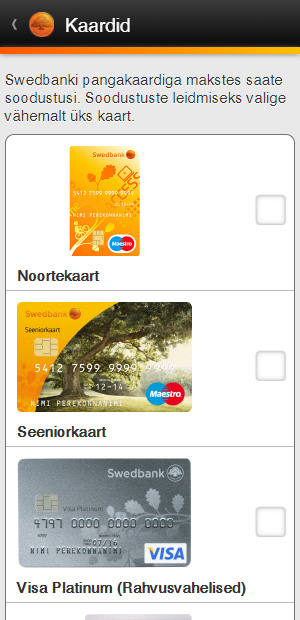

Swedbank offers a wide range of financial services for private persons and businesses. One of them is the loyalty program for bank card holders. Thanks to it, every client can use special offers and discounts when purchasing goods or services from the bank’s partners.

The problems Swedbank encountered

Absence of a well-organized communication between all participants of the loyalty program:

- The card holders did not know the locations where they could get a discount for goods/services

- The bank’s partners did not find it profitable to grant discounts to Swedbank’s clients

- The bank did not expand its client base with the aid of this loyalty program

Lack of resources for implementation of a high-tech solution:

- Swedbank did not have the experience and competent staff to develop a hybrid application using the same technologies as mobile devices and common computers

The solutions implemented by UX GENIUS specialists:

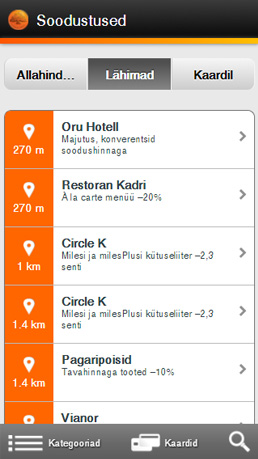

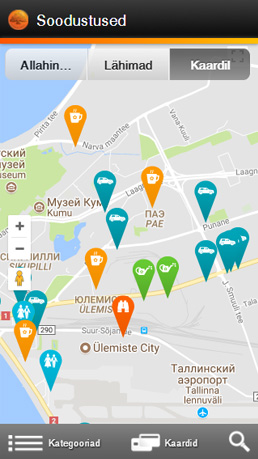

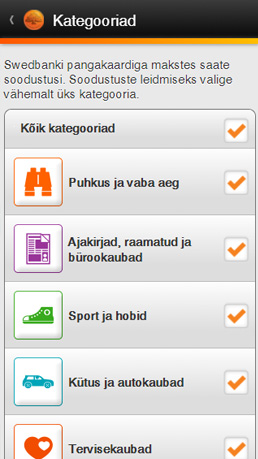

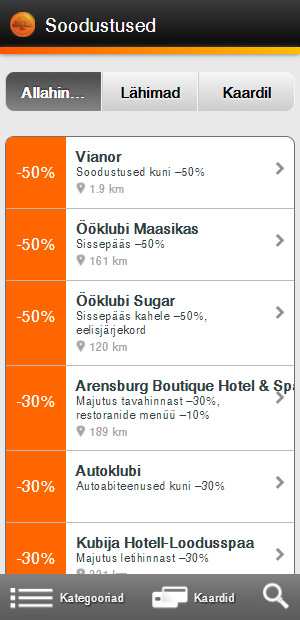

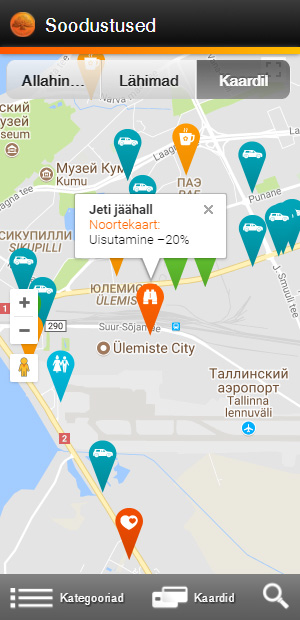

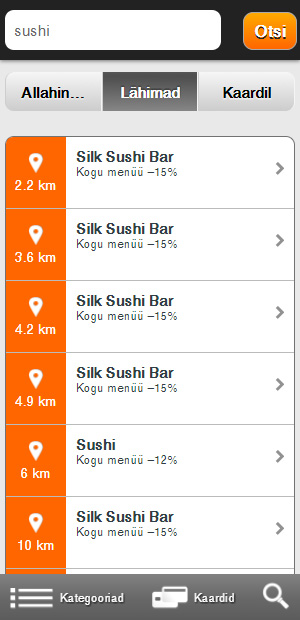

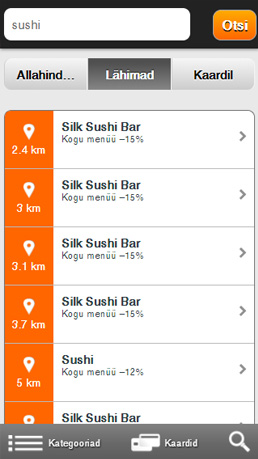

Development of a mobile application allowing the user to see the nearest locations where a discount is offered with their card.

Connection of the existing system with the new options. At that moment, Swedbank already had a working system for entering the data of partners who granted discounts. The existing system had to be synchronized with the mobile application and with the page about the partners' discounts at the online bank.

Creation of an Internet search engine at Swedbank’s online bank that would help users find discounts with their cards and topics.

Why did UX GENIUS turn out to be a suitable partner?

Our main task was the masterly technical implementation:

The mobile application

The application’s features on the online bank’s page for desktop computers

Integration of the above-listed systems with the existing system for entering the data of Swedbank’s partners

The technical result

- A universal data structure, an interface for its exchange (API).

- Minimization of information transfer between the bank’s servers and the application.

- Minimum load on the server due to the mobile application's fast work.

The data structure created by us and the API work with desktop and mobile versions. Its universality opens the possibility for other developers to create their applications using the data about Swedbank’s discounts.

Based on the master drawings by Swedbank’s designer, our specialists have developed interactive interfaces for the mobile and desktop applications and the entire program logic for their work.

The advantage of our approach is the crossplatformity of the application. It has been written in strict compliance with the HTML5, JavaScript, and CSS3 web standards.

The application works excellently on common mobile systems such as iOS and Android. And it will work on any new device or system that supports web standards and has a browser.

Such an approach to creation of the application decreases the expenses on its maintenance at least by 2 times, as the application code is the same for all platforms. It means that there is no need to modify the applications for iOS and Android separately. It is enough to make changes in one location, and all the platforms will update to the latest version.

The business result

-

The buyer.The card holder can quickly and easily find the bank’s partners to use the lucrative offers of the loyalty program.

-

The seller.The partner of Swedbank increases the sales turnover due to the additional flow of clients, and gains recognition among potential customers.

-

The bank.Swedbank receives its bonuses in the form of the clients’ positive and trusting attitude to the service, and also additional profits from card operations due to the transaction turnover growth. It confirms that the well-organized “Buyer-Bank-Seller” system works quickly and efficiently.